Foreign trade statistics of Kazakhstan worsened in the beginning of this year. That might be the first reason to Kazakhstani tenge losing index points against the US dollar.

The National currency of our country is in the stable balance because of the intervention by National Bank of Kazakhstan in order to provide stability during the snap elections for the Mazhilis of Kazakh Parliament. Now, after the elections, financial regulator starts to save money in its assets sending tenge to floating exchange rate.

Trade volume

In January 2015, the volume of foreign trade of our country was reduced by 28,9% (export for 39,2% and import increased by 1,8%) in annual expression comparing with the previous year.

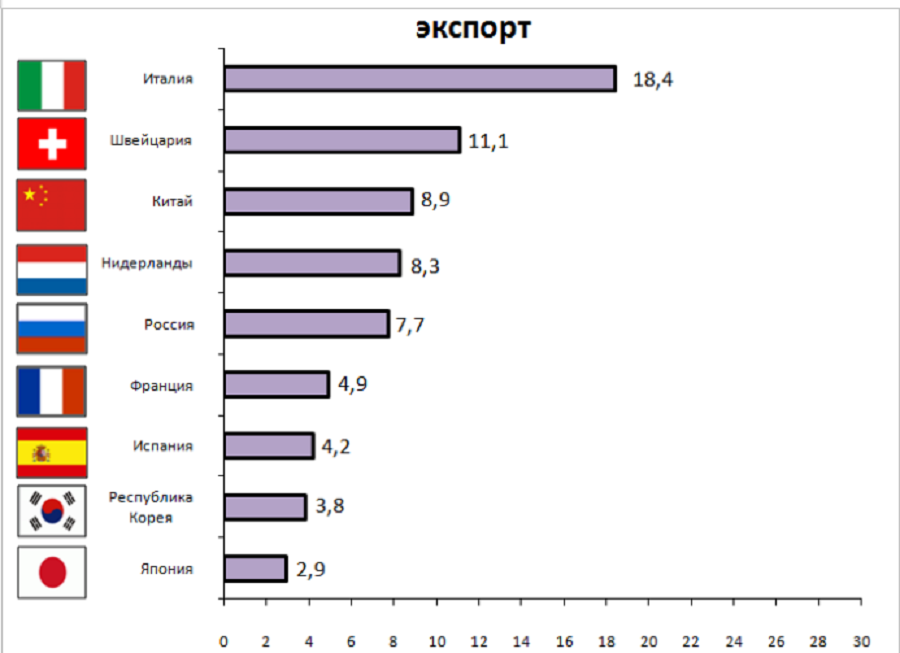

[caption id="attachment_39813" align="alignnone" width="900"] Export statistics of Kazakhstan in January 2016[/caption]

Export statistics of Kazakhstan in January 2016[/caption]

In the beginning of 2016, rates of the recession in foreign trade have considerably accelerated. Foreign trade commodity has been decreased by 42,3% for $4,3 billion, including export (42,6%, $2,75 billion) and import (41,6%, $1,5 billion).

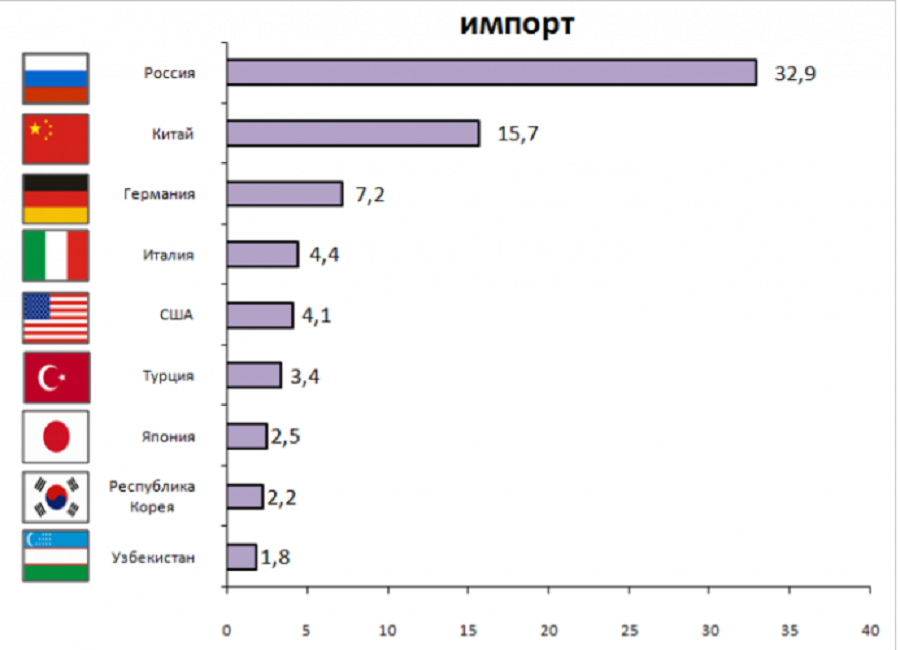

[caption id="attachment_39814" align="alignnone" width="900"] Import statistics of Kazakhstan in January 2016[/caption]

Import statistics of Kazakhstan in January 2016[/caption]

Actually, the trade volume wasn't decreased. The impact on deterioration in a statistical information was strained by the devaluation of tenge against the American currency because the foreign trade of all the countries of the world shows in the US dollar equivalent and the reduction of the prices of the raw materials which are exported by Kazakhstan.

Kazakhstan's negative results in trade turnover with the neighbour countries went down to $214,8 million because of the open borders with the Eurasian Economic Union. Especially, Kazakhstan's volume has decreased for $302,7 million in the trade with Russia in January. it's quite obvious that even the next sharp devaluation of tenge won't help to cover all previous deficits.

US dollar could help to strengthen Kazakhstani tenge

At current days, something abnormal happening in the world's currency market. US dollar is strengthening in the face of negative informs about the other IMF's powerful currencies.

[caption id="attachment_39812" align="alignnone" width="900"] EUR/USD Point Index (screenshot from Teletrade)[/caption]

EUR/USD Point Index (screenshot from Teletrade)[/caption]

As we reported earlier, American currency continues to grow against other currencies of IMF. US dollar is going up because of the strengthening of expectations that FRS will capable of increasing its interest rates in April.

But, the another case show that American currency could begin in its devaluation in the next two-three weeks, according to KTK.

It is noted, the Federal Reserve System (FRS) of the USA has begun to curtail procedure of attraction of its state debts.

As it is explained, the American treasury actively attracted debts, carrying out placement of state bonds on record volumes. They reached even 60 billion dollars.

Economists are sure that more it won't be. Besides they consider that devaluation of the dollar is necessary for the industry of the USA as the branch is in a deplorable state: for the last year industrial production in the States has dropped by 11 percent.

Also, the TV channel quotes the analyst of VTB24 Alexey Mikheyev who believes that expensive dollar makes an adverse effect on the industry of the USA, and it can't long proceed." (...) We believe what prior to the large-scale decline of dollar remained from two weeks to one month. Though formally decline of the dollar has already begun as assets of all types have grown in the last two weeks", - he has told.

Written by Zholdas Orisbayev, follow on twitter: @joldas_os