The ongoing oversupply of oil will keep prices down until 2017, much later than previously forecast, despite some major producers such as Canada are likely to freeze projects under construction, experts at the International Energy Agency (IEA) said Monday.

In its annual Medium-Term Oil Market Report, The situation, however, won’t help prices, says the EIA, a Paris-based organization of 29 major oil importing nations, especially because efficiency gains will push U.S. output to new records by the beginning of the next decade.

“We are likely to see continued capacity increases (in) the near term, with growth slowing considerably, if not coming to a complete stand still after the projects under construction are completed,” the energy report said.

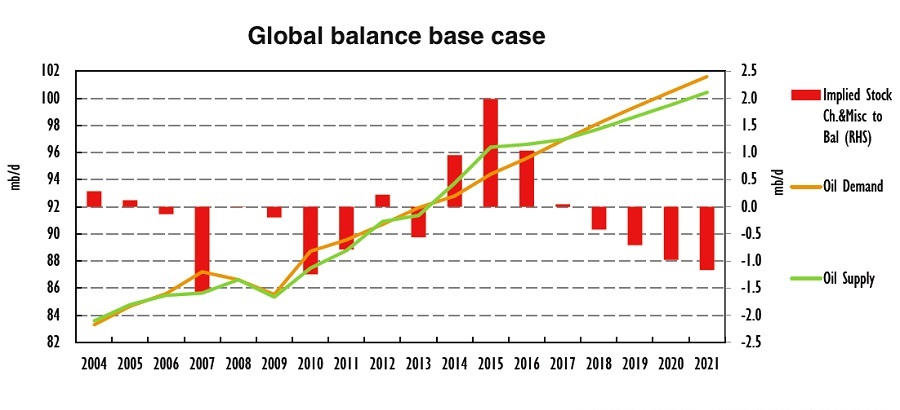

[caption id="attachment_37127" align="alignnone" width="900"] Source by IEA[/caption]

Source by IEA[/caption]

Last year, the agency had forecast a "relatively swift" recovery. Instead, oil prices have continued to fall, reaching a level below $30 a barrel last seen in 2003.

The IEA blamed "extraordinary volatility" in oil markets for its changed outlook, adding that crude supplies have surged more than expected. This, said the IEA in a statement, has been caused by a three-year rise in stocks, a phenomenon last seen in the mid-1990s.

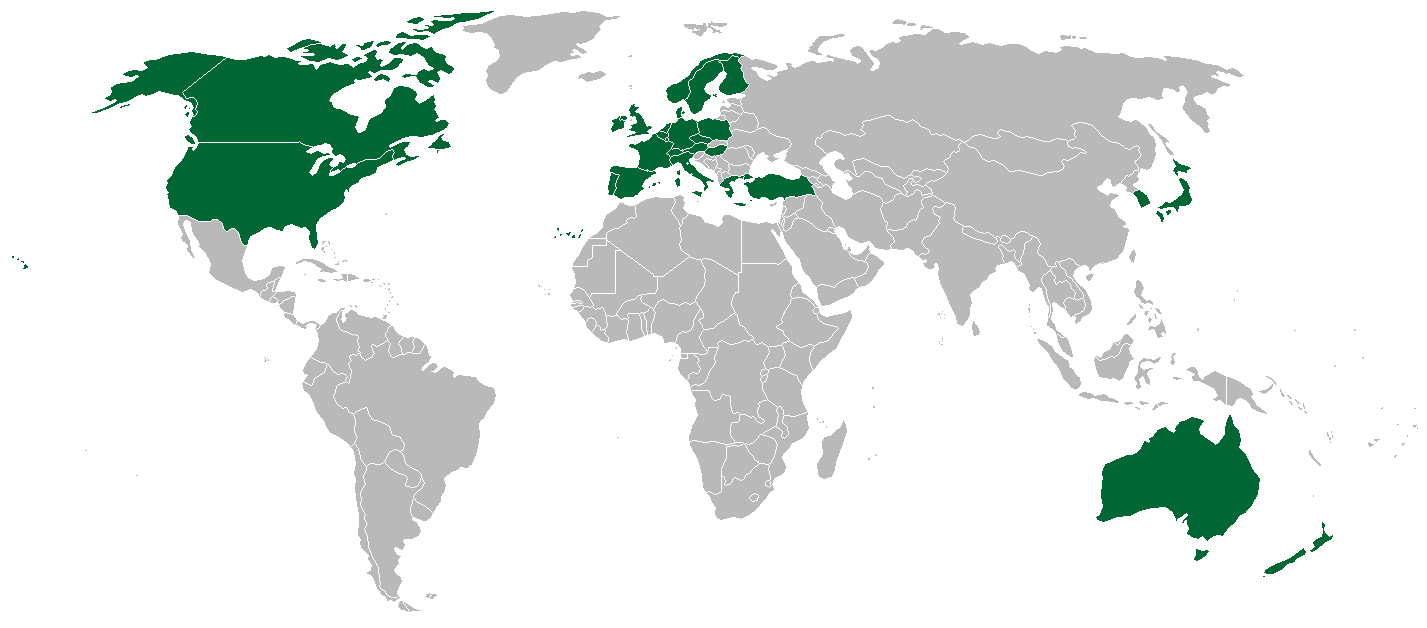

[caption id="attachment_37128" align="alignnone" width="1427"] Members of IEA are in green in the map, © ewea.org[/caption]

Members of IEA are in green in the map, © ewea.org[/caption]

The agency also noted that while oil prices should start to rise gradually once the market begins rebalancing, the availability of resources that can be easily and quickly tapped will limit the scope of rallies — at least in the near term.