Zimbabwe, a country once so gripped by the madness of hyperinflation that the central bank could no longer afford paper on which to print practically worthless trillion-dollar notes now has an altogether more modern problem: it is stuck in deflation.

Like Britain, Japan, the US and other nations dealing with the consequences of weak demand and cheap oil, Zimbabwe is menaced more by the prospect of falling prices than by rising ones.

According to the best estimates of an economy in which statistics are about as murky as the goings-on inside Robert Mugabe’s ruling Zanu-PF party, consumer prices fell by between 2 and 4 per cent last year. Many economists believe deflation could persist in 2016 as demand shrinks and cash-strapped companies lay off staff or stop paying wages.

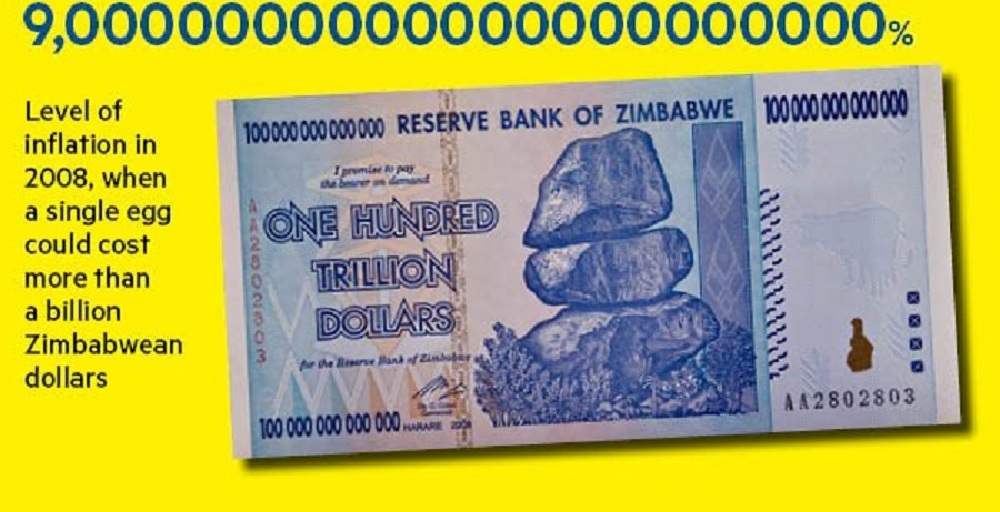

Falling prices are a novelty. Back in 2008, when annual inflation peaked at 89.7 sextillion percent — that’s roughly 9 followed by 22 zeros — a single egg could cost well over a billion dollars, assuming you could find one. [caption id="attachment_33759" align="alignnone" width="1000"] You can buy 10 eggs with this note[/caption]

You can buy 10 eggs with this note[/caption]

“For the man in the street, deflation looks good,” says a local banker. “But the economist will tell you that the economy is stagnating . . .[that] the country is going through a period of deindustrialisation.”

People have less money, whether denominated in vanishing Zimbabwe dollars or rock-solid American ones, he says. “As long as there’s no production in the economy, it doesn’t matter what currency you use.”Resource: Financial Times

Photo: www.startribune.com